The first step, as suggested by Dave Ramsey’s book, is to record the monthly financial ins and outs. We are going to calling this, Maintaining the Family Finance. To do this, I have a worksheet that I have been using for the last six years. Prior to reading the book, I only kept track of the main expenses and their monthly due dates. Many of my monthly memberships that were automatically deducted from my credit card such as Audible, the kids’ after school activities, etc were not recorded. Instead, I calculated a monthly estimate of my credit card statement balance and kept account of only that. After reading the importance of knowing exactly where every penny is spent, I added in those expenses to my spreadsheet.

So here’s how to do it:Once you’ve downloaded the excel file, follow the steps below to complete your monthly Ins and out. This process can take up to a month or more (for some) to fully complete. So, allow your self some slack.

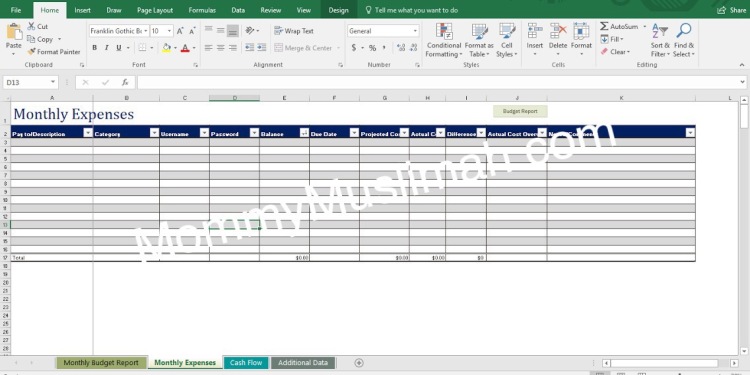

The only page you should concentrate on completing for this first part is the Tab titled “Monthly Expenses”.

How to complete the worksheet:

- Column 1: Pay to/ Description- Add the creditor or Payee’s name.

- Column 2: Category- Select the category that best fits your need. If the categories in the drop down menu do not fit your expenses, skip this step. Once you have completed the entire worksheet, you may scroll down to the section titled, “How to edit expense categories” to learn more about changing the categories to better suit your need

- Columns 3 & 4: Username & Password- If you would like to keep track of your online username and password, enter it here. You may choose to leave this blank.

- Column 5 Interest Rate- If the account you are listing is a loan, please record the interest in this column (even if it is financed at 0%).

- Column 6: Balance- If the account you are listing contains a balance, please use this column to keep track of the outstanding balance.

- Column 7: Due Date- In this column, please type in the MONTHLY due date for the account. This is NOT the same as the final payment or payoff date of a loan.

- Column 8 Projected Cost- Here you will record the amount allocated (or budgeted) for the payee. For example, if you estimate your electricity bill to be $175 every month, you may choose to budget $200 monthly (as a safe measure). In that case, you will record $200 in the column for Projected cost.

- Column 9: Actual Cost- I use this column to keep track of my all time maximum cost. However, the correct way to use it is to record the actual cost once a statement is issued for that account. By doing this, you will be able to see how well you stayed within your budget for each month.

- Column 10: Difference- This column is automatically calculated. It will calculate the difference between your budget and actual expense.

- Column 11: Notes/Comments- In this column, please list any and all notes or comments you have pertaining to the account such as

Note : If you need additional lines, right click on one of the numbers (on the left), and click on INSERT.

All about the other worksheets in the Spreadsheet

Monthly Budget Report:

In this worksheet, most of the fields auto populate. If it does not auto populate, you may right-click on the table and select REFRESH. Here, you can also add your monthly income (both projected and the actual income). Since we have only one source of income that we receive once a month, its easy to keep track of. So, I don’t actually use this part of the spreadsheet.

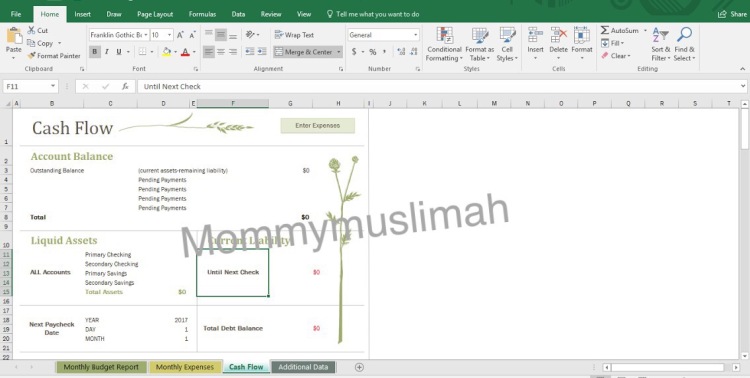

Cash Flow:

The cash flow worksheet is one that I do use A LOT. Because we utilize every penny of our income towards paying off debt, it is important to know how much money will remain in the account once all payments have been made. For this, you will first need to change the Paycheck Date (located on the bottom left side of the worksheet). As soon as the NEXT PAYCHECK DATE is changed, the worksheet will automatically calculate the CURRENT LIABILITIES section for that pay period. In order to calculate and be sure that there is enough money in the bank, you must update the LIQUID ASSETS section. Be sure to list all accounts that you are able to withdraw funds from.

The account balance section at the top of the worksheet will automatically calculate the difference in the liquid assets minus the liabilities. Here, you can also add in any pending payments that are not recorded in the Monthly Expenses, such as checks written for gifts or a one time ACH payment.

Finally, the Additional Data Tab:

If you need to make any changes in the expense categories section, this is the worksheet where you would make those changes. Clear the cells of those categories which are not needed or you may choose to replace the category with one that is better suited for your needs. Click on the arrow (circled in red in the image above) to sort the categories. You may have to click once or twice to arrange the categories in such a way that the blank categories will be at the bottom of the list. Highlight the cell and right click to delete. To add categories in addition to the ones listed, right click towards the bottom of the list and insert a cell (repeat for additional cells).

Click HERE to download the financial spreadsheet